Empowering You To Pursue Your Financial Goals

FINANCIAL PLANNING

Know Where You’re Going

At A.I.D. Wealth Management, we take the time to sit with our clients to discuss each aspect of their financial life. We will provide a comprehensive financial plan which includes analysis of a client’s personal finances along with their current financial position.

Investment ADVICE

We provide a detailed risk tolerance assessment for our clients to complete. Upon evaluating the results of this assessment and then discussing the importance of proper asset diversification and tax sensitivity with our clients, we will proceed to appropriately allocate their investment dollars. We will continually monitor the level of concentration, diversification and appropriateness of the portfolio as regular life changes occur and make recommendations accordingly. We use the latest technology and alerts to address and rebalance portfolios as needed to ensure that they stay within acceptable risk limits.

RETIREMENT PLANNING

We utilize state-of-the-art software to help project both retirement income and costs. From this we will develop a plan that optimizes the likelihood for our clients to enjoy their retirement years. This plan can include maximizing various retirement accounts, stress testing the portfolio for unexpected downturns and discuss those options that will help maximize social security benefits.

INSURANCE NEEDS ANALYSIS

We along with our strategically aligned CPA and P&C Insurance firms will review insurance and risk mitigation strategies. We make recommendations on no less then a yearly basis based on the results of our formalized personal and professional insurance audit process.

DEBT MANAGEMENT

We review the outstanding debt ranging from credit card to mortgage and everything in between. We analyze various factors and work with clients to develop a plan to most effectively manage this debt by using various debt reduction alternatives.

ESTATE NEEDS ANALYSIS

We provide an overview for each individual, family and multi-generational estate planning needs. Along with a team approach when necessary to include their attorney, banker and CPA, we can address the need for a Will, Living Will, Trust, POA, Health Care Directive, Life Insurance, ILIT, etc.

CASH FLOW PLANNING

We analyze our clients’ current expenses and annual budgets and monitor spending to assure we are making appropriate assumptions in our financial plans. Also, we project long term cash flows to help clients not only visualize their retirement incomes but future target date obligations and/or opportunities i.e. College, Weddings, Bar/Bat Mitzvah, Second Home, Charitable Endowments etc.

EDUCATION PLANNING

We evaluate the amount of education funds that may be needed based on projected costs of higher education, what type of school may be desired and the alternative funding vehicles available. We also evaluate available tax features and opportunities for scholarships and grants, along with the potential need for financial aid and school loan options.

TAX PLANNING

While we do have tax experts on staff that include Chartered Financial Consultants, Certified Financial Planners and CPA’s, we do not provide traditional tax and accounting services. As financial planners, we utilize our expertise to assist in the projections of current and future client income, gift, capital gains and estate planning needs. We help manage our clients’ investments and retirement savings accounts based upon each client’s specific situation. We can do this through the use of various strategies and investment vehicles that include, but are not limited to, Municipal Bonds, Tax Deferred Instruments, Mutual Funds, REIT’s, Tax Loss Utilization, IRAs, Roth IRAs, Pensions, PSP’s, 401(k) and various other tax strategies.

BUSINESS SUCCESSION

Business succession planning refers to the practice of using various concepts, strategies and/or financial vehicles to increase the chances for the survival of usually a family business, when one or more of the business owners retires, becomes disabled or dies unexpectedly. We help to address such issues as who within the family or company has the capability to run the business, will the loss of an owner eliminate much-needed cash or cash flow, how will the family of the exiting shareholder insure that they will be fairly compensated for their ownership stake in the business and how should this be designed in order to most efficiently mitigate the various tax ramifications of the succession? Most of these questions can be answered with a well-prepared Buy-Sell Agreement. The most important aspect of Business Succession Planning is for the owners to become convinced that they need to take proactive planning steps, or understand that their family business will likely disappear. We will methodically spell out the differences between the “do nothing approach” and implementation of a well thought out approach.

INVESTMENT MANAGEMENT

Steps To Get You “There”

Our approach is to properly assess a client’s risk tolerance, create a custom allocation model that reflects the client’s objectives and tolerance, manage the portfolio in a cost and tax efficient manner and finally re-examine and adjust the model as a client needs or expectations shift.

CLIENT RISK AND TOLERANCE OBJECTIVES

We start by having a client complete a thorough financial planning questionnaire to quantitatively pinpoint their respective risk tolerance. This portion of the questionnaire identifies the investment risk a client is willing to accept. Having this information provides us the required information needed to move forward from this step.

IMPLEMENTATION

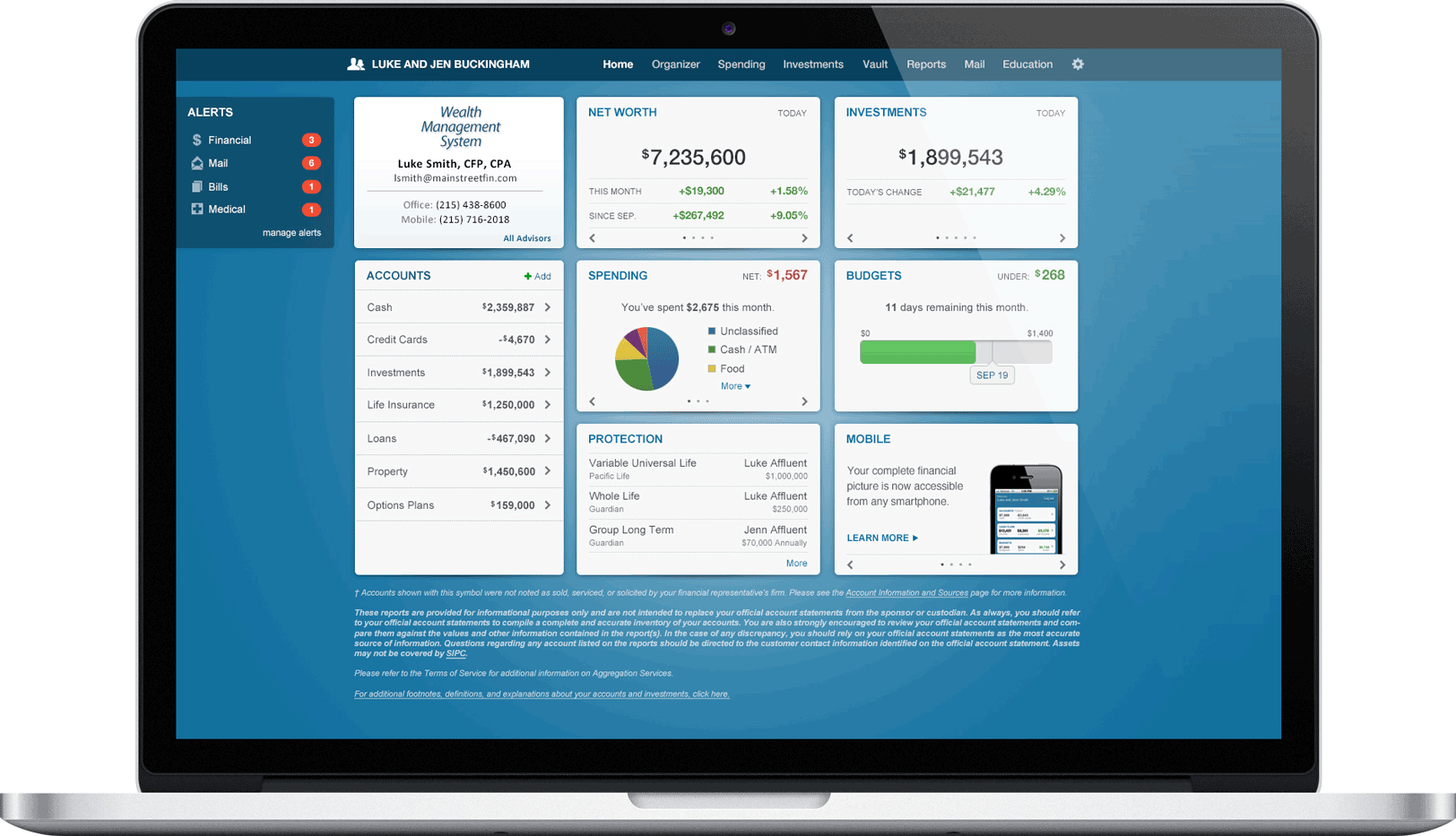

Once the proper allocation and account placement is selected, we utilize the latest technology to begin our starting portfolio discussion. Upon agreement of all the potential fees, risk factors and projections, we begin the portfolio implementation process. Going forward we utilize technology that monitors the weightings and alerts us to potential rebalancing opportunities and potential tax harvesting opportunities. Regular oversight ensures that the portfolio risk remains in balance with the identified client risk acceptance.

OBJECTIVE PORTFOLIO CREATION

As a full service independent financial services firm, we will exercise our core value of providing objective advice and investment selections that are based on our client’s needs. We examine a wide range of potential investments to identify what products will best create a portfolio that reflects this. Primary screening includes but is not limited to manager quality, fees, and tax efficiency.

MONITORING AND ANNUAL REVIEW

Portfolios are consistently monitored throughout the client-advisor relationship. We require at minimum an annual review to re-evaluate risk tolerance, any life changes or any life goal changes (check out our annual review video above). We reflect any changes in the profile with a portfolio adjustment proposal and examine the effects of the changes on a tax basis, cost basis, and potential expected return and yield basis.

Start Funding Your Future

COMPLIMENTARY FINANCIAL PLAN

*While other firms in our industry charge on average $1,900 for a traditional financial plan, A.I.D. will provide it at no cost.

*Source: The College of Fin. Planning 2011 Survey Trends

NO MINIMUM

Whether you consider yourself to be wealthy or not, A.I.D. has made it a company core value to provide financial guidance to those that want it and need it.

UP-FRONT FEE DISCLOSURE

Structured in a way that works best for our clients, we make our fees and commissions clear at the start of the client-advisor relationship.

Get In Touch

At A.I.D. Wealth Management, we take pride in providing an unparalleled level of service to private clients, family offices, and businesses alike. We’d like to do the same for you.

1 W Las Olas Blvd. 5th Floor

Fort Lauderdale, FL 33301

(888) 667-4750

info@aidwealthmanagement.com

START THE CONVERSATION

© 2022 A.I.D. Wealth Management, All rights reserved.

Securities and Investment Advisory Services offered through A.G.P. / Alliance Global Partners, Member of FINRA | SIPC, a Registered Investment Adviser. Neither A.G.P nor any of its affiliates provide legal, tax or accounting advice.

Investing always involves risk; no investment is protected against loss. Past performance does not indicate future results. Diversification does not ensure a profit or protect against declining markets. Consider your investment objectives before investing.

A.I.D. Wealth Management is affiliated with The A.I.D. Group

The A.I.D. Group is not a registered broker-dealer or investment advisory firm. The A.I.D. Group and AGP are independent and not affiliated entities.

Check the background of our investment professionals on FINRA's BrokerCheck

Business Continuity Planning Summary & Disclosure

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The CLU® and ChFC(R) marks are the property of The American College, which reserves sole rights to its use, and is used by permission.